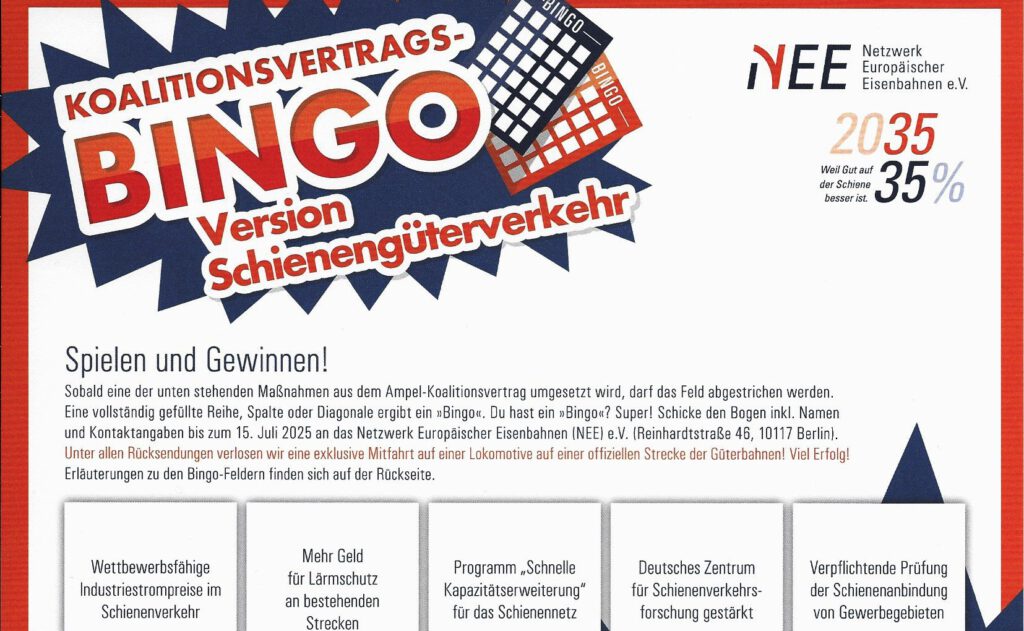

The association “NEE – The Freight Railways” went public in Germany in January 2022 with a “coalition agreement bingo”. The Berlin-based non-profit interest group for non-state railway companies in freight transport promised a “win-win situation”. The NEE raffled off an “exclusive ride on a locomotive on an official freight railway route” among the winners of the game. But only those who ticked as many boxes as possible on the bingo sheet to complete a row could win. Each filled-in cross meant that the German government had pushed through a positive decision for freight transport by rail. Our blog reported on the topic at the time.

All bingo? Excerpt from the 2022 tip sheet. Credits: NEE

All bingo? Excerpt from the 2022 tip sheet. Credits: NEE

An allocation of a winner will probably be difficult.The coalition of the three parties Social Democrats, Greens and Liberals collapsed in Germany in November 2024, almost a year earlier than sceduled.The Corona epidemic also thwarted some of the government’s plans.For example, there were the NEE demands: “Competitive industrial electricity prices in rail transport” and “Plan for the phase-out of coal in traction power generation by 2030 is in place”.The government first had to secure the basis for energy production after Russian gas was largely lost as a source of production due to the Russian war in Ukraine.

“New public-interest-oriented rail infrastructure division operates profit-free”: In fact, the previous subsidiary of Deutsche Bahn DB Netz was converted into the public-interest-oriented DB InfraGo AG.There is still criticism of the work of this company.But a real step has been taken.”Tolls are also used for alternatives (traffic finances traffic)” – this point has also been met.Revenue from the use of motorways by trucks in Germany can now also be spent on rail projects.

However, all rail transport companies are threatened with a heavy burden due to price increases for the use of rail routes. The freight railways even speak of a “price shock”. DB InfraGo explains the price increases as follows: “In order to finance the inflation-related increase in personnel and maintenance costs, an average fee increase of around +6% for the 2024/2025 network timetable period of +16.2% for the rail freight transport is unavoidable. Due to the legal regulations and decisions of the Bundesnetzagentur, the fees for local rail passenger transport (SPNV) will only be increased by +0.6% compared to the previous year. This capping of the SPNV fees leads to an increase in fees for rail freight transport (SGV) and long-distance rail passenger transport (SPFV), which from the point of view of DB InfraGO AG places a disproportionate burden on both market segments.”

Rail infrastructure was neglected for years

In 1994, a railway reform merged the previous West German Federal Railway and the Reichsbahn of the defunct GDR to form today’s Deutsche Bahn AG. The key politicians at the time were of the mistaken opinion that the new DB could finance its own costs from the company’s income. For years, too little money was invested in the rail infrastructure. The last two German governments counteracted this. They significantly increased spending on rail infrastructure.

But the last federal government was unable to spend as much money as was necessary and planned.This was countered by regulations on a state “debt brake”, compliance with which the Federal Constitutional Court demanded and which the liberal finance minister interpreted in a particularly restrictive manner.

Average increase of more than 19 percent

The DB is therefore to receive the new money it needs from the state as additional equity capital amounting to 4.5 billion euros and not as a direct subsidy from the federal budget. The capital subsidy can be noticeably larger. But this has negative effects on the cost structure of the DB infrastructure manager. InfraGo speaks of “additional costs”: “These arise from depreciation and capital costs and cause the majority of the overall cost increase.” The DB has to pay interest to the federal government for the equity increase. InfraGo, in turn, has to pay this interest due to a statutory regulation. A regulation in the Regionalisation Act currently limits the increase in fees to a maximum of 3 percent – a de facto decoupling from the actual costs of maintenance and operation. For 2025, the Federal Network Agency has even limited the increase in track access prices in local rail transport to 0.6 percent.

Rail industry: “Less railway for more money!”

But DB is suing against this cost limitation. A first ruling is expected in the third quarter of 2025. In anticipation of a positive ruling, DB InfraGO is applying to the responsible Federal Network Agency for further drastic increases in track access prices for 2026 compared to 2025: 23.5 percent for local rail passenger transport (SPNV), 10.1 percent for long-distance rail passenger transport (SPFV) and 14.8 percent for rail freight transport (SGV). This corresponds to an average of 19.1 percent.

The railway industry fears that such exorbitant increases in transport costs will cause customers to switch to the road for passenger and freight transport.

This would result in the opposite of the desired ecological transport transition. Sarah Stark, managing director of the railway industry association, explained: “There is a risk of less rail transport for more money. It is therefore all the more important that the federal government now introduces a Modern Rail Act in order to create a planning-proof, multi-year financing architecture with a rail fund.”

Hermann Schmidtendorf, editor-in-chief